Launch Angel Investor network in Lagos, Nigeria

The Lagos Innovation Hotspots is an initiative of the Co-creation Hub aimed at mapping hotspots representing clusters of emerging high growth and competitive businesses across Lagos. The current map, which has more than 170 listed businesses provides information on each cluster, businesses and location-based support services and illustrates exciting developments now underway in Lagos.

As the local community of entrepreneurs grows, a growing number of organizations and investors are looking to engage them. This was highlighted by the announcement of EchoVC, a Silicon Valley-based venture capital firm. The new fund aims to invest $30 Million into Sub-Saharan Africa Start-ups and the team is comprised of former Intel Capital director, Eghosa Omoigui, early-stage technology investor, Shadi Mehraein and former VC Finance at Founders Fund, Amber Fowler.

This news was followed by the recent launch of the ‘Lagos Angel Network,’ a platform that brings together individuals and organisations seeking to invest in and mentor Nigerian technology start-ups. LAN is an initiative of Wennovation Hub. Founding Partners include the World Bank, InfoDev, Tony Elumelu Foundation and Alitheia Capital. The initiative is headed by VC4Africa member Tomi Davies and currently counts 15 Angel investors. Members of the network are expected to commit at least $6,000 a year to a common investment pool.

The time to start a new technology venture in Nigeria couldn’t be better!

Venture Capitalist take a look at the challenges investing in African tech

VC4Africa was pleased to host the panel, ‘Strengthening the VC pipeline’ at the 9th Annual Conference for the African Venture Capital Association meeting hosted in Accra.

VC4Africa was pleased to host the panel, ‘Strengthening the VC pipeline’ at the 9th Annual Conference for the African Venture Capital Association meeting hosted in Accra.

I was joined by Yemi Lalude, Managing Partner of Adlevo, Tayo Oviosu, Founder and CEO of Paga, Karima Ola, CIO of the African Development Corporation, Mathew Boadu Adjei, CEO of Oasis Capital and Arjuna Costa, Director of Investments at Omidyar Network. The time we had was limited for getting into all of the issues we wanted to cover, actually there is more than enough content for a stand alone conference on the subject, but here are some of the points I felt were raised during our different conversations.

– Within the emerging African focused VC space there is a inherent leaning to scalable concepts and a natural orientation toward financial services. As penetration rates increases across African countries, banking services are the first step to unlocking e-commerce activity that will drive the ecosystems development.

– Challenges with market size remain a key constraint. Ghana at 8.4% Internet penetration is looking at somewhere around 1.2 million users compared to the 4.3 million found in Nigeria. The numbers are far less in countries like Tanzania, Ethiopia or Uganda. Innovation can come from anywhere, initially incubated and tested in Accra, Kampala or Dar, but how can a venture then find its way into bigger markets next door?

– Operating in a country like Zambia can be extremely expensive. Sales operations might be in Lusaka, but don’t be afraid to put the back office in CapeTown. Where Nigeria is where a company might want to expand its network of merchants, the programmers and technical staff might be based in Accra. Staff are easier to find, higher quality and therefore cheaper. And it can be as simple as the company needing better power supply and reliable infrastructure.

– There is a need for more qualified entrepreneurs. For the organizations that can, investing into the support ecosystem remains important. Platforms like incubators are critical to developing new networks of entrepreneurs. That said, do the existing platforms successfully produce new ventures and how do we make sure entrepreneurs graduate and get into the market successfully? A stronger link to business development is needed and is a point being addressed by incubators like ActivSpaces in Buea, the Nailab in Nairobi and MEST in Accra.

– There is a growing amount of capital looking to engage ventures at an early stage. It might not be enough, as many entrepreneurs are quick to make clear, but certainly the environment is improving. Two panelists had angels. One happened to be from the US and one happened to be Dutch. Both offering a million USD plus. But we also met local Ghanaian angels investing in early stage ventures here in Accra and we see a growing number of ventures finding early stage support this way. No surprise we see the rise of local angel networks like the Ghana Angel Investor Network (GAIN). A challenge for many entrepreneurs is in developing these contacts and here more could be done to matchmake on a local level. At VC4A we do this via meetups brining the member base together in an informal way that sees lots of business cards exchanging hands.

– Government does have a role to play. Legislation that helps to protect IP is critical. But also efforts like the Ghana Venture Capital Trust Fund. A facility that has helped Ghana based investors top up their funds. More success stories would give governments the opportunity to bolster these programs and expand them. In Kenya the government has gone so far as to promote the development of Konza, an entire tech city.

– Tech is different than sectors like housing, education, agro, etc… Where the first subscribes to a culture more attune to Silicon Valley, the other, more traditional sectors, are more often family run businesses. The approaches to building a portfolio are quite different. The business model and exit plan are also adjusted. Taking from revenue might be more attune for a business when run by a family that isn’t actually looking for an eventual acquisition.

– Average size of ventures on the tech side are still quite small in size. The economics for a pure play early stage tech fund in many cases doesn’t make sense. As a result, some investors have a carve out and allocate a % they can put into early stage technology ventures. Fitting the investments into a larger portfolio can improve a fund’s balance sheet and be more appealing to investors.

– Costs are high. Traveling in Africa is more expensive than traveling across the US. Hotels are not cheap. Qualified staff are not cheap. Secure power and working infrastrcuture can add to the cost base. These costs stretch what can be facilitated with a traditional managetment fee.

– Exits were not a primary concern, although many investors question the point. That said, If you build a business with real scale, there is confidence exit opportunities will emerge. Possibly an exit within the industry as larger funds look to fill their own pipelines with qualified ventures. If you don’t have a long view, and an underlining faith in the market, you probably shouldn’t be involved.

I will look to build on these points moving forward and as always I invite your feedback, thoughts, questions and ideas. Certainly, progress is being made every day and this conference and our time in Accra was testament to that.

Africa produces the next Facebook, Groupon, Zynga or Google

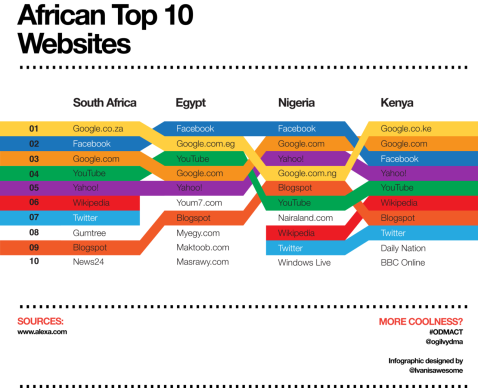

This info-graphic was produced by Ivan Colic. Located in South Africa, he started a great series devoted to the visualization of African data called Afrographique.

On April 7th Mfonobong Nsehe published ‘Why Africa May Never Produce a Facebook, Groupon, Zynga or Google’ in Forbes. Rightly, he calls for a need for investors to step forward and support promising African startups. I share this call to action, but also recognize the progress that is already being made. We have plenty of African startup success stories and there are more on the rise every day. Investors need to get involved now or we will simply pass them up.

Just last week TxtEagle raised $8.5 million from a consortium of investors including Spark Capital and RBC Venture Partners. This is big news when you consider most of the ground work and prototyping was done in Kenya. TxtEagle leverages USSD protocol that averts many of the costs that restrain SMS use in emerging markets. Their innovative approach has the potential to engage billions of people who till now have been hard for many organizations to reach. They already build on partnerships with 220 mobile operators in almost 100 countries who between them cover 2.1 billion subscribers. That’s 28.5% of the global population and is clearly another African designed platform with global potential. Is this not an example of a global product like Facebook, Groupon, Zynga or Google?

And there is no shortage of capacity and I agree with Mfonobong that Africa has some extremely intelligent techpreneurs. I think its a remarkable accomplishment when someone like John Waibochi, the founder of VirtualCity, walks away with USD 1 million from Nokia and beats out software developers from the U.S, Canada and India! And great African techpreneurs don’t just come from Nairobi 🙂 NandiMobile, a start-up from the MEST Incubator won “Best Business” award at the LAUNCH conference in San Francisco. They were in competition with almost 100 Silicon Valley start-ups!

And let’s remember that Nigeria is about to get seriously connected. We are talking about 5.12 Tbit/s in capacity that will come to shore with the West Africa Cable System. This is four times the celebrated SEACOM cable behind a lot of the tech startup energy and buzz we share in Nairobi. The speed of the WACS cable is such that one could theoretically download about eight million MP3 files or over eight thousand DVDs per minute! And investors aren’t waiting around to see what happens. Already Pagatech announced that they have received investment from Tim Draper, a renowned Venture Capitalist based in the United States from Draper Fisher Jurvetson.

Speaking about his investment in Paga, Draper said “My decision to make this personal investment is premised on the simple fact that I believe in the bold vision of the Paga team and I trust in their ability to execute. Paga is a great innovation which will simplify life for millions of people in Nigeria and beyond. I look forward to the company being a major African success story that serves as an example for many more to come.”

There are exits too. South African Mark Shuttleworth, the founder of Thawte, a web security and certificate authority company, sold his business for nearly a half billion USD. So let’s be clear. Investors need to get involved today or they risk missing out on a unique opportunity at a unique point in time.

Crunch your business idea in seconds, check out the new VC4Africa.biz website! :)

Ever go to a website where you had to spend 3-4 hours uploading your business plan? And maybe then you never heard from a real person again? There is probably nothing more frustrating to an entrepreneur. I mean lets face it, time is money and every second you spend on documentation you could spend doing business.

With the VC4Africa.biz Matchmaking platform we do things differently. Using plan cruncher we can get your plan online with a few simple mouse clicks. Any entrepreneur can breeze through the questions (with a Twitter limit of 140 characters :)) and actually have fun selecting the icons. Before you know it you have crunched your business idea into one page and it’s online.

Investors and other members can quickly scan your idea and ask you questions if they need clarification. They can also like your idea and help rank it to the top of the list. We capture all of this activity and interaction. At the end of the day it’s the best ideas and the most serious entrepreneurs who claim the top spot. It is these entrepreneurs that are the most likely to secure investment.

Want to crunch your idea?